Savings Account

In this Page

- First Content

- Second Content

- Third Content

- Fourth Content

A Mintyn savings account makes saving money easy and rewarding. Our high-yield savings account comes with competitive interest rates, innovative financial digital products and resources, and a secure platform for your peace of mind.

Join us today, and let’s build a better financial future together. Start saving! Start thriving!

What is a Savings Account?

A savings account is a bank account that gives you a secure and convenient way to save money for your future needs, emergencies and dreams. A Mintyn savings account is indeed a great starting point for wealth-building! You can get a Mintyn savings account in 3 quick and easy steps.

How does a Savings Account Work?

When you open a savings account, you’re essentially lending your money to the bank, which pays you interest on your deposits. This interest accrues over time, allowing your savings to grow. Unlike other investment options, savings accounts are low-risk, making them ideal for funds you can’t afford to lose.

With a savings account, your money is always accessible. You may withdraw it when needed. This makes the savings accounts an excellent choice for emergency funds or short-term savings goals. Mintyn, as a digital bank, offers online banking, making it convenient to manage your savings from anywhere.

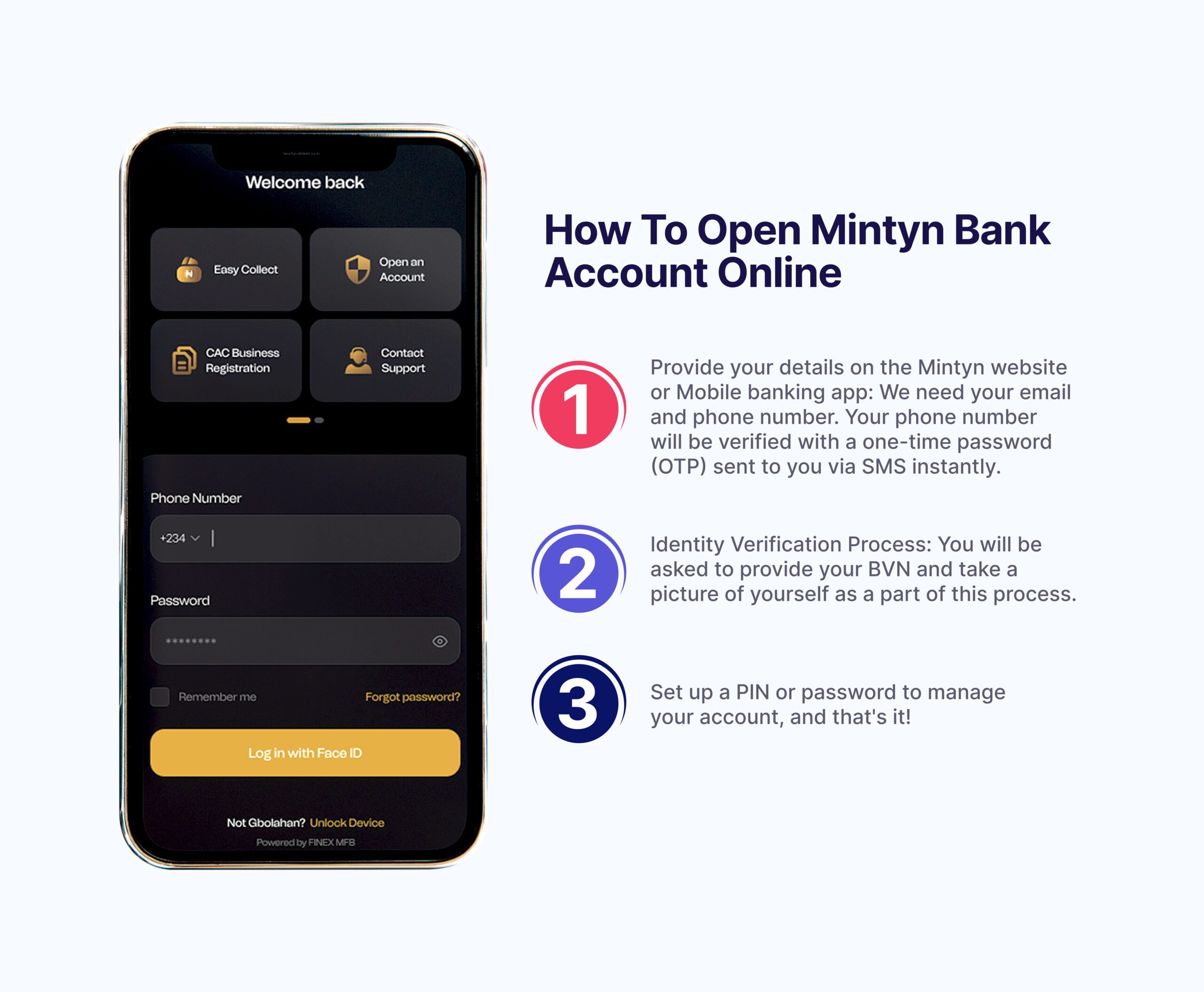

How To Open a Savings Account Online at Mintyn

Opening a Mintyn savings account online is very fast and easy. You can open a Mintyn bank account by following 3 quick and easy steps.

Steps: How to open a Mintyn savings account online:

1. Provide your details: We need your email and phone number. Your phone number will be verified with a one-time password (OTP) sent instantly via SMS.

2. Identity Verification Process: You will be asked to provide your BVN and take a picture of yourself as a part of this process.

3. Set up a PIN or password to manage your account, and that’s it!

Requirements: What should you have?

1. An internet-enabled device, a smartphone, is preferred.

2. An active phone number and email

3. Your Bank Verification Number (BVN)

4. A valid government-issued form of identification: national ID card, driver’s licence, international passport, etc.

Providing Documents Digitally

Our digital-first approach ensures that you can provide the necessary documents digitally, making the process efficient and secure.

1. Scanning or Photographs: You can scan your documents or take high-quality photographs of them. Ensure that the images are clear and legible.

2. Secure Upload: Navigate to the document upload section on our website or mobile app. Follow the prompts to upload your documents securely.

3. Verification Process: Our team will review your submitted documents. You’ll receive email updates on your application status, so you’re always in the loop.

By providing the required documents digitally, you save time and resources. It’s part of our commitment to delivering a hassle-free banking experience in today’s fast-paced world.

What Should I Have in Mind When Choosing a Savings Account?

Selecting the right savings account is a crucial financial decision. It’s not just about finding a secure place to put your money. It’s about optimising your savings to meet your financial goals and aspirations. At Mintyn, we understand the importance of this choice.

We’re here to guide you through the key factors to consider when choosing a savings account that aligns with your unique needs.

1. Interest Rate: The Foundation of Earnings

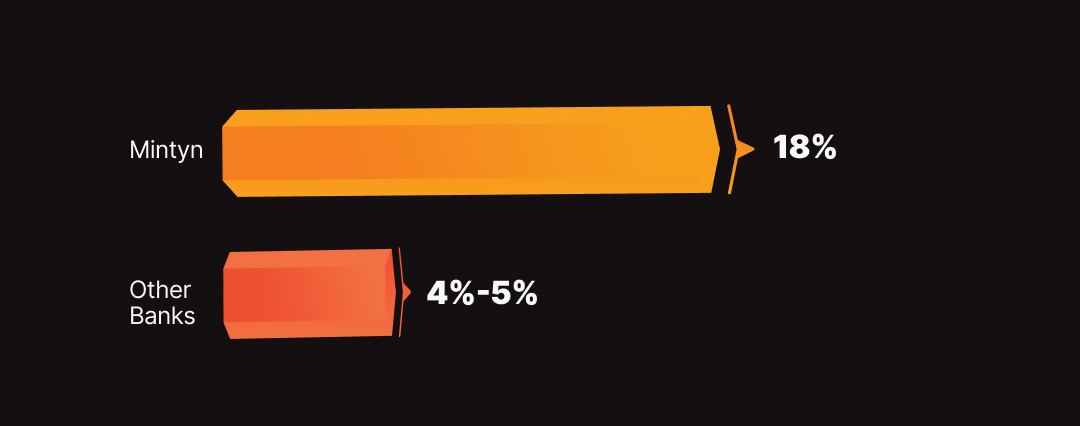

Interest rates are the foundation of your savings growth. A higher interest rate means you earn more money over time. When choosing a savings account, compare the interest rates different banks offer. At Mintyn, we offer a competitive interest rate of up to 18% to ensure your money works as hard as you do.

2. Minimum Balance Requirements

Some savings accounts require a minimum balance to open and maintain. It’s essential to consider whether you can meet these requirements comfortably. At Mintyn, we offer a range of savings account options, including those with no minimum balance requirements, to cater to various financial situations.

3. Fees

Be aware of any fees associated with the savings account. Common fees include monthly maintenance fees, withdrawal fees, and transaction fees. Mintyn is committed to transparency, and we offer fee-free savings accounts to help you keep more of your hard-earned money.

4. Online and Mobile Banking

Nowadays, virtually all bank customers look out for the convenience of online and mobile banking. Being able to manage your savings account online, check balances, and transfer funds at any time is invaluable. Mintyn offers a user-friendly digital platform to provide a seamless banking experience.

5. Customer Service and Support

Consider the level of customer service the bank provides. In the event of an issue or query, you want prompt and reliable support. Mintyn takes pride in its customer-centric approach, with a dedicated customer service team ready to assist you on a 24/7 basis.

6. NDIC Insurance

Ensure the bank is covered by the Nigerian Deposit Insurance Corporation (NDIC). This insurance protects your deposits. NDIC protects deposits at Mintyn, providing added peace of mind for your savings. Join Mintyn today, and let’s work together to make your financial dreams a reality.

Why Should I Open a Savings Account with Mintyn?

You may currently have a savings account with one of the traditional banks; that’s great! But at Mintyn, we’d like to expose you to the new and exciting benefits of a digital bank savings account. You will see that traditional banks might just be a thing of the past!

If you’re looking to open your very first savings bank account, you’re already in the right place!

Benefits of a Mintyn Savings Account

1. Convenience

Access your savings 24/7 from the comfort of your home, on the go, wherever you are. No more waiting in long lines or travelling long distances.

2. Higher Yields

Maximise your earnings with our competitive interest rates. Mintyn gives you interest of up to 18% on your savings. Watch your money grow faster than ever!

3. Safety and Security

Rest easy knowing your savings are protected with our robust technology features, in line with global best cybersecurity practices.

4. Easy Management

Say goodbye to paperwork and endless forms. Our user-friendly interface makes managing your savings very easy. Our mobile banking app lets you set transaction limits, limit or block your cards, change your PIN, budget, track and manage your spending, and so much more!

5. Instant Access

Need your funds in a hurry? With a Mintyn savings account, you can access your money wherever and whenever needed!

6. Minimum Balance Requirement

There is no minimum balance requirement on a Mintyn savings account.

7. 24/7 Customer Service and Support

Your peace of mind becomes our priority after you open a bank account online with us! We don’t just want to be your bank; we want to be a financial partner that provides you round-the-clock support! If you have a question, need help with a transaction, or want to resolve an issue, our dedicated customer support team is just a call or email away! Anytime and Anywhere!

Open a Mintyn savings account today to get started!

An Environmentally Friendly Savings Account with Mintyn

A Mintyn savings account is where the future of banking meets environmental responsibility. Embracing digital banking goes beyond the convenience of managing your finances; it’s a step towards a greener, more sustainable future. Mintyn contributes to environmental responsibility by reducing paper usage and minimising your carbon footprint.

Environmental Responsibility

Reduced Paper Usage

In our commitment to environmental responsibility, we’ve significantly reduced the need for paper in your financial transactions. Traditional banking often involves countless sheets of paper for statements, receipts, and documentation. In contrast, Mintyn offers a paperless approach that helps conserve valuable resources.

By opting for our digital Savings Account, you play a part in reducing paper production, ultimately saving trees and minimising the environmental impact of paper manufacturing. Say goodbye to physical statements and hello to the convenience of accessing your financial information digitally.

Minimised Carbon Footprint

Every action counts in combating climate change. Traditional banking practices, with their reliance on paper and needing customers to commute to bank branches, have a considerable carbon footprint. In contrast, digital banking is a game-changer in minimising this impact.

When you choose our savings account, you choose a bank that cares about the environment. By conducting your financial transactions online, you reduce the need to travel to physical branches, which means fewer cars on the road, less fuel consumption, and reduced greenhouse gas emissions. In other words, it’s not just your financial burden that gets lighter; it’s the environmental burden as well!

How Does Mintyn Make a Difference?

Paperless Statements: Access your account statements, transaction histories, and documents digitally. No more cluttered file cabinets or stacks of paper. Our digital platform lets you securely view, download, and store your financial records.

E-statements: Receive your account statements through secure electronic delivery. Not only do you get quick access to your financial information, but you also help save trees and reduce paper waste.

Online Banking Tools: Our online banking tools, like checking balances and reviewing transactions, promote a greener banking experience. With these features, you can manage your finances efficiently without needing printed documents.

Reduced Travel: With our mobile app and online banking, you can conduct your banking activities from the comfort of your home. There’s no need for frequent visits to a physical branch, cutting down on your carbon emissions and contributing to a cleaner environment.

Join Us in Making a Difference! Start banking with Mintyn today!

Minytn Helps in Setting Your Financial Goals

At Mintyn, your financial success is our success, and we are here to help you every step of the way. Let’s begin to set and achieve your financial goals with our savings account! Financial goals are the roadmaps that lead us to our dreams and aspirations.

Whatever your long or short-term goal is, whether you’re saving to buy a house, pay rent, buy that phone, pay your tuition, etc. A Mintyn Savings account is here to help you achieve it!

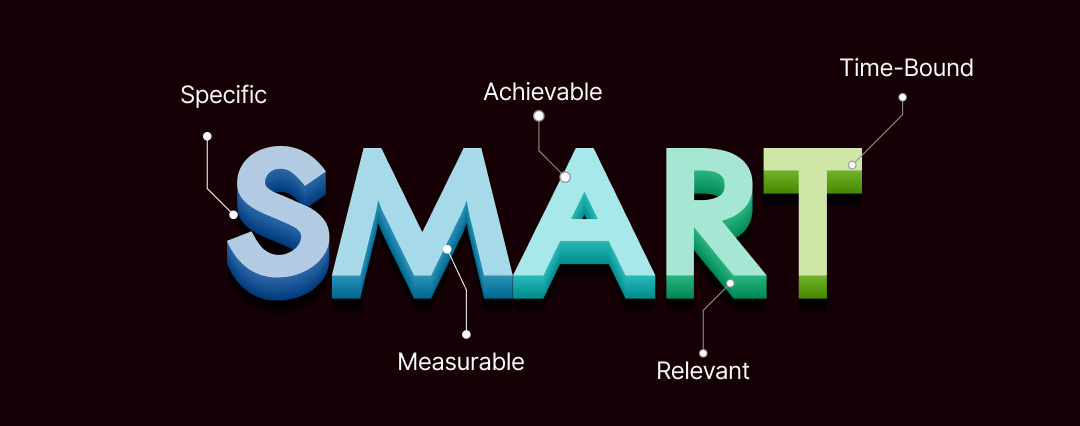

Realise Your Financial Goals the SMART Way

Mintyn aims to be not just your bank but your trusted financial companion. If your short-term or long-term financial goal is to save for a car, buy a house, pay rent, pay tuition, or purchase a phone, you can realise it with a SMART savings approach.

A SMART savings approach can help you create a well-defined savings plan. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Here’s how to apply it:

1. Specific: Define your long or short-term savings goal clearly. For example, “I want to save money for the rent on my apartment.”

2. Measurable: Determine how much money you need to save. For instance, “I need to save N800,000 for rent.”

3. Achievable: Make sure your goal is realistic and feasible while considering your income and expenses. Assess your financial situation to confirm that saving N800,000 is indeed realistic.

Mintyn’s CoinBuddy and SpendMapster may also assist you in this regard by helping you plan and monitor your expenditure.

4. Relevant: Ensure that your goals correspond with your financial objectives and needs; for example, saving for rent is a relevant financial objective for a tenant.

5. Time-bound: Set a timeframe for achieving your goal. For instance, “I want to save N800,000 for the rent of my apartment by the end of the year.”

Now you have a SMART goal! Next, you break it down into actionable steps:

– Determine your monthly savings target: in this case, it’s N800,000 / 12 months = N66,670 per month.

– Review your budget with CoinBuddy and SpendMapster : Identify areas where you can cut expenses to allocate more money towards savings.

– Open a Mintyn savings account: Make monthly deposits and enjoy our competitive interest rates.

– Track your progress: Regularly monitor your savings to ensure you’re on track to meet your goal.

Adjust your plan over time to stay aligned with your SMART goal. This approach will help you stay focused and motivated as you work towards your savings target.

Building Your Emergency Funds with a Mintyn Savings Account

Why Do You Need an Emergency Fund?

Life is indeed unpredictable, and certain unwanted circumstances, such as sudden medical expenses, car troubles, job loss, etc., may come when you least expect them. Having funds set aside may prevent you from being harshly impacted by such events.

In such circumstances, you would greatly appreciate the financial security of an emergency fund. Let us assist you on this journey towards financial security. Open a Mintyn Savings account today! At Mintyn, we understand the importance of building emergency funds. We are here to guide you on your journey towards creating a financial safety net that you can rely on in case of an unexpected event.

How Much Should You Save?

The amount of money you put towards building an emergency fund depends on your circumstances as an individual. The size of your monthly income, financial obligations, expenses and financial objectives would all determine this.

A common rule of thumb is to save at least 20% of your monthly income. A Mintyn Savings account will ensure your money works for you while it’s set aside for emergencies. Start an Emergency fund with a Mintyn Savings account today!

Maximising Your Savings with a Mintyn Savings Account

Mintyn is dedicated to helping you maximise your savings and taking control of your financial future. Your financial dreams and aspirations can become a reality with the right strategy and a reliable financial partner.

A Mintyn High-Yield Savings Account offers a competitive interest rate of up to 18% to make your money work for you. With no minimum balance requirements and easy access to your funds, growing your savings has never been easier!

Investment Plans: We also encourage you to take further advantage of our high-yield investment plans, namely Flex Pro, Flex Plus, Flex Elite, Yield Max Pro, Yield Max Plus and Yield Max Elite, which give returns between 9% and 18% at maturity.

Savings Account for Your Life Milestones

Life is an extraordinary journey filled with significant milestones, dreams, and aspirations. From buying your dream home to funding your children’s education or planning those unforgettable holiday trips and weddings, these moments define our lives.

Yet, achieving these milestones often requires careful planning and intelligent financial decisions. This is where a Savings Account with Mintyn can make all the difference!

Savings Account: Your Pathway to Achieving Major Life Milestones

At Mintyn, we understand the significance of life’s major milestones. That’s why we’ve designed our Savings Account to empower you on your journey, making your dreams become a reality. A Savings Account can help you save for 3 of life’s most important milestones.

1. Buying a Home: Your Dream House Awaits

Why a home? Owning a home is a significant achievement, offering stability and a place to create lasting memories. It’s an investment in your future, providing a sense of belonging and security.

How Mintyn Can Help: With our competitive interest rates and user-friendly platform, we make it easier for you to save for your dream home. Here’s how:

I. High-Yield Savings: Our Savings Account offers some of the best interest rates in the industry, helping your money grow faster. With a Mintyn savings account, you enjoy interest rates of up to 18%

II. Personalized Goals: Use our financial tools (CoinBuddy, SpendMapster) to set and track your home-buying goals, ensuring you stay on the right path.

2. Education Expenses: Invest in Your Future

Why Education? A quality education is an investment in the future, whether for your child’s education or your own. It opens doors to opportunities and personal growth! How Mintyn Can Help: We understand the importance of education and offer features to help you save for it.

Our Savings Account is designed to fit your needs, allowing you to save at your own pace. With our NDIC insurance, your funds are protected, ensuring your hard-earned money is safe as you save for your education goals.

3. Unforgettable Celebrations: Celebrate Life’s Joys!

Why Celebrations? Life’s special moments, such as weddings, graduation ceremonies, significant birthday anniversaries, etc., deserve to be celebrated in style. These experiences create cherished memories with loved ones.

How Mintyn Can Help: We know that you want to create unforgettable experiences, and our Savings Account is your partner in making it happen. Open a Mintyn Savings Account to get started today!

24/7 Customer Support

Our dedicated customer support is here to assist you if you have questions about your account or need financial guidance.

Your dreams of owning a home, having a quality education, and having unforgettable celebrations are within reach. The key to achieving these life milestones is careful planning and smart saving. A Savings account with Mintyn is your pathway to turning these dreams into reality.

With competitive interest rates, user-friendly tools, and top-notch security, we offer the support you need to reach your financial goals. Whether you’re saving for a down payment on a home, an education fund, or that dream wedding, we’re here to help you every step of the way.

Don’t let life’s major milestones be out of reach. Start saving today with Mintyn and take the first step towards turning your dreams into cherished realities. Your brighter future begins here.

Testimonials

SomtoChukwu

“This bank is the most convenient, user-friendly, and swift bank I have ever experienced in the financial space. It takes me less than a second to log in and consummate my transactions. I’m glad I came across a banking app like Mintyn that bridges my financial transaction needs to be tailored to my lifestyle. Well done, Mintyn, for your extraordinary service”

Asido

“During these difficult times when cash is scarce, Mintyn Bank has proven to be the ideal choice for me when it comes to transfers. The speed is incredibly fast, and payments are received by the recipient faster than ever. Additionally, I love shopping on the Mintyn Marketplace due to the attractive price discounts. Using the Mintyn app is truly amazing”.

Dencillion

“It’s a kind of app and online bank I prefer mostly because it has no stress at all. It is very good and calm to save money, keep it up Mintyn!”

Karen King

“Wait, why didn’t anybody tell me about this @Mintynapp since? So this is what you people have been enjoying? Transferring money without any transfer fee? Nawa oh, I thought we all agreed to help each other.”

Mohammed Ibrahim

“Beautiful app with very good support service. Keep it up!”

Samora I. Fortune

“Guys @Mintynapp is not just a bank. They also offer premium financial services. With MINTYN BANK you can draft your monthly budget, you can view a proper statistics of your income and expenses.”

Frequently Asked Questions

In this Page

- First Content

- Second Content

- Third Content

- Fourth Content